Mobile banking apps have become the primary interface between financial institutions and their customers. As the market becomes increasingly saturated, banks and banking app development companies face the challenge of distinguishing themselves in a sea of digital offerings.

With countless apps vying for users’ attention, creating a unique and compelling brand identity has never been more crucial.

This article explores innovative branding approaches for mobile banking apps, examining both successful strategies and those that fall short, providing valuable insights for financial institutions and developers alike.

The Power of Simplicity

Minimalist Design Trends

One of the most effective branding approaches in mobile banking is the embrace of minimalist design. This trend moves away from complex, feature-laden interfaces towards clean, intuitive layouts that prioritize user experience.

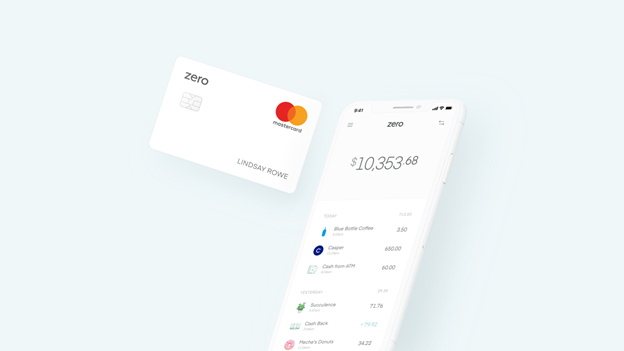

Case Study: Zero’s Approach

Zero, a fintech company, exemplifies this approach with its mobile banking app. The application employs:

- A strong, distinctive logotype

- Crisp typography with personality

- Bright colors and patterns inspired by world currencies

- Ample white space to create a sense of lightness

This minimalist aesthetic not only creates a visually appealing interface but also helps users focus on their financial data without distraction.

The result is a brand identity that feels modern, efficient, and user-centric.

Emotional Connections Through Design

The Impact of Emotional Branding

While banking has traditionally been viewed as a purely rational domain, innovative companies are discovering the power of emotional branding in financial services.

Example: Dave the Bear

Dave, a financial services app, has successfully incorporated emotional design into its branding strategy. The company’s approach includes:

- An animated bear mascot that guides users through financial processes

- Personalized advice delivered through a friendly, supportive character

- Lively sound effects and visual rewards (e.g., confetti animations) for financial achievements

By infusing personality and positivity into typically stressful financial activities, Dave creates a unique brand identity that resonates with users on an emotional level.

Approaches That Don’t Work: Overcomplexity and Feature Overload

While innovation is crucial, some branding approaches in mobile banking apps prove counterproductive.

A common pitfall is the tendency to overcomplicate the user interface or overload the app with features in an attempt to stand out.

The Pitfalls of Overcomplexity

- Cognitive Overload: Apps with cluttered interfaces or too many options can overwhelm users, leading to frustration and decreased engagement.

- Increased Learning Curve: Complex designs often require users to invest significant time in learning how to navigate the app, which can deter adoption.

- Diminished Brand Identity: When an app tries to do everything, it often fails to excel in any particular area, diluting its brand identity.

- Performance Issues: Feature-heavy apps may suffer from slower load times and increased battery drain, negatively impacting the user experience.

Building a Digital Ecosystem

The Rise of Super Apps

A more successful approach to comprehensive service offering is the development of digital ecosystems or “super apps.”

This strategy involves creating a platform that seamlessly integrates various financial and lifestyle services without overwhelming the user.

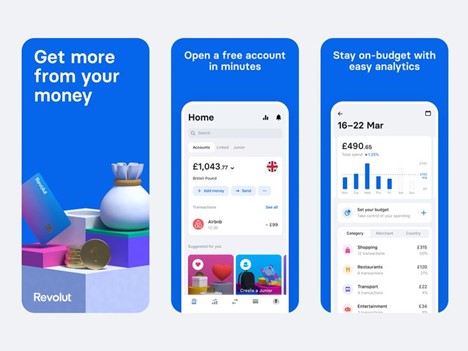

Revolut’s Expansive Approach

Revolut, a digital banking platform, has successfully implemented this strategy. Their app offers:

- Core banking functionalities (payments, savings)

- Cryptocurrency trading

- Budgeting and analytics tools

- Insurance products

- Lifestyle services (travel bookings, donations)

By thoughtfully integrating these services into a cohesive platform, Revolut has created a brand identity that positions itself as a comprehensive financial lifestyle app without sacrificing usability.

Gamification: Engagement or Gimmick?

The Pros and Cons of Gamified Banking

Gamification has emerged as a popular trend in mobile banking app design, aiming to increase user engagement and make financial management more enjoyable.

However, its effectiveness as a branding strategy remains a subject of debate.

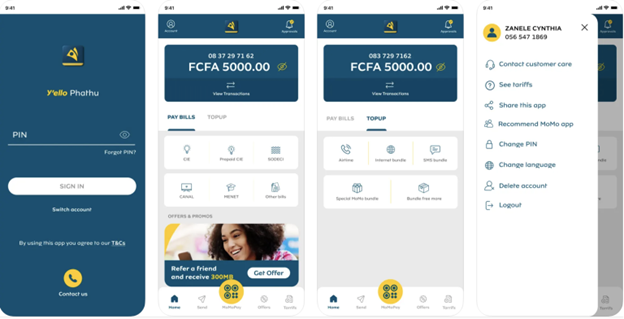

Success Story: Momo’s Gamification Strategy

Vietnamese fintech company Momo has successfully implemented gamification in its super app. Their approach includes:

- Interactive games like “Momo Jump” with real-world rewards

- Challenges tied to financial activities (e.g., making transfers, paying bills)

- A points system exchangeable for various prizes

However, it’s crucial to note that gamification must be implemented judiciously.

Some users prefer a more serious approach to financial matters, and overzealous gamification may undermine the perceived reliability of a banking app.

Personalization and Customer Journey

Tailoring the Experience to Individual Users

As users increasingly expect personalized experiences, successful mobile banking apps are focusing on customizing the user journey to individual needs and preferences.

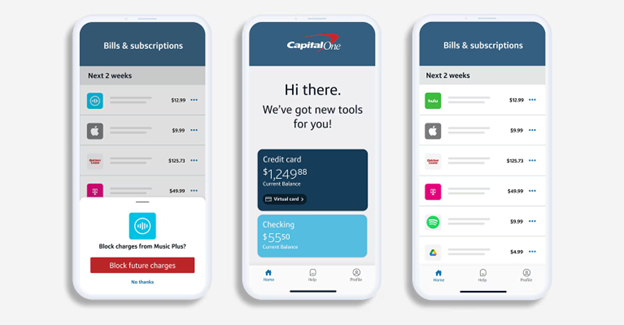

Capital One’s Comprehensive Feature Set

Capital One’s mobile banking app exemplifies this approach, offering:

- Disposable virtual cards for secure online shopping

- AI-powered chatbot support for personalized assistance

- Customizable alerts and notifications

- Tailored financial insights and recommendations

- Flexible account opening processes

By providing a range of features that users can tailor to their needs, Capital One creates a brand identity centered on customer-centric innovation and personalization.

The Role of Design Systems

Ensuring Consistency Across Platforms

As mobile banking apps become more complex, design systems play a crucial role in maintaining brand consistency and streamlining development processes.

The Atomic Design Approach

Many banking app development companies are adopting the atomic design methodology, which breaks down interfaces into reusable components:

- Atoms: Basic UI elements (buttons, input fields)

- Molecules: Groups of atoms (search bars, menu items)

- Organisms: Complex UI components (headers, forms)

- Templates: Page layouts

- Pages: Specific instances of templates

This approach ensures visual and functional consistency across the app while allowing for flexibility and scalability in design.

Conclusion

The landscape of mobile banking app branding is dynamic and multifaceted. Successful strategies balance simplicity with functionality, emotion with practicality, and innovation with user-centric design.

Key takeaways for financial institutions include:

- Prioritize user experience and interface simplicity

- Incorporate emotional design elements thoughtfully

- Develop comprehensive ecosystems without overwhelming users

- Implement gamification judiciously

- Focus on personalization and tailored user journeys

- Utilize robust design systems for consistency and scalability

As the digital banking space continues to evolve, brands that can adapt to changing user needs while maintaining a clear and compelling identity will be best positioned for success.

The future of mobile banking branding lies not just in technological innovation but in creating meaningful, user-centric experiences that resonate with customers on both practical and emotional levels.